As jy 'n biotegnologie-beginnersonderneming is wat in 2024 na fondse kyk, is jy of blykansig genoeg om 'n neufiguur-venture rondte verhoog, of jy soek vir wat oorgebly het.

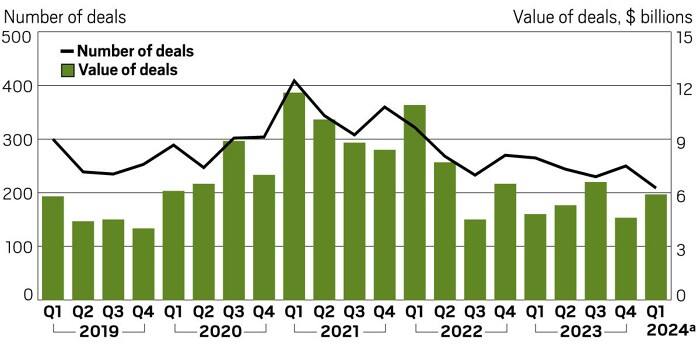

In die eerste kwartaal van hierdie jaar, het biotegnologie- en farmasie-ondernemings gelyktydig $5,9 miljard oor 209 rondtes ingesamel, volgens die nuutste Venture Monitor-rapport van PitchBook en die National Venture Capital Association (NVCA). Die dollarbedrag is 'n toename ten opsigte van die gemiddelde per kwartaal in 2023, maar dit versprei oor minder transaksies. Die totale aantal transaksies is die laagste sedert die derde kwartaal van 2018, toe PitchBook 202 venture rondtes getrek het. Hiervoor was slegs 2016 'n jaar met so min transaksies.

Die daal is spesifiek laag onder vroeë-fase transaksies. Bedryfsoplettendes sê beleggers is steeds risikosker en as gevolg daarvan prioriteit gee aan belegging in maatskappye waarvan die geneesmiddel-kandidate verder ontwikkel is.

“Ek dink die grens is steeds hoog,” sê Katie McCarthy, hoofinnovasiebeampte by die Halloran Consulting Group. “Beleggers het regtig hul verwagtinge herstel. Hulle wil verseker wees dat daar 'n redelike hoeveelheid risiko is.”

Daardie beginondernemings wat daarin geslaag het om die trend te trotseer en ‘mega-rondtes’ – $100 miljoen of meer – op te rig, het 'n paar dinge gemeen.

Voor een, beleggers sal steeds waarskynlik ervare bestuurspanne ondersteun. Chris Garabedian, portefeuljebestuurder by die venturefirma Perceptive Advisors en CEO van die versneller Xontogeny, verwys na die presisie-geneeskunde-beginonderneming Mirador Therapeutics. Mirador is in Maart gelans met $400 miljoen in risikokapitaal. Wat so 'n jong beginonderneming vir beleggers 'n seker weddstryd maak, beweer Garabedian, is hul stigters: Mark McKenna en 'n paar ander uitvoerende van Prometheus Biosciences het hul vorige maatskappy aan Merck & Co. verkoop vir $10,8 miljard.

„As jy op 'n bewese span kan wed . . . nou, in plaas van $4 miljoen in 10 maatskappye te steek, laat ons $400 miljoen in een steek,“ sê Garabedian. „As jy $4 miljoen in 10 maatskappye steek, diversifiseer jy die risiko, maar jy neem ook meer bestuursrisiko.“

Soortgelyk word Synnovation Therapeutics, 'n kankervennootskap wat in Januarie met $102 miljoen gedebuteer het, gelei deur verskeie voormalige uitvoerende bestuurders van Incyte wat tydens hul loopbaan daar meerdere kommersiële medikamente gelanseer het. FogPharma, wat in Maart $145 miljoen ingesamel het, is gestig deur die skeikundige en seriele ondernemer Greg Verdine en word tans gelei deur Mathai Mammen, 'n veteraan by Johnson & Johnson.

Beleggers neig ook meer daartoe om klinies gevalideerde wetenskap te finansier – dit is, gene-kandidaat wat in menslike onderwerpe getoets is. Cour Pharmaceuticals, wat in Januarie 'n rondte van $105 miljoen afgesluit het, het meerdere Fase 2 studie in uitvoer vir hul nanopartikel-gene, en Latigo Biotherapeutics se voorspoedige genekandidaat vir pynverligting was reeds in Fase 1 proewe toe die beginvend in Februarie met $135 miljoen gelanceer is. Latigo se samestelling LTG-001 werk op dieselfde wyse as 'n Vertex Pharmaceuticals gen, wat beleggers ekstra vertroue gee aangesien die Vertex gen onlangs suksesvol in 'n Fase 3 studie geslaag het.

Carolina Alarco, stigter en hoof van die raadgewende maatskappy Bio Strategy Advisors en 'n engelbelegger, maak sorg dat hierdie situasie 'n sekondêre probleem skep: dat biotegnologie moontlik sy ‘rand’ verloor deur nuwe programme te ontprioritiseer.

“Ervaringsrye CEO's en stigters beweeg gewoonlik na bewese tegnologieë en platforms om die grootste moontlikheid van sukses te hê,” sê Alarco. “Jong ondernemers en wetenskaplikes, hulle het die ware innovasie. Hulle het die werklike behandeling wat oor 10 of 20 jaar sal kom. Ek dink ons doen 'n diens aan wetenskap deur nie 'n paar fondse vir hierdie hoogst innovatiewe benaderings oop te maak nie.”

Toegewese, daar is nog baie kapitaal wat op die sylyn sit—and beleggers kan slegs so lank wag om dit te plaas. Vennote-groepes moet gewoonlik cheques binne 'n sekere tydperk uitskryf of die geld teruggee aan hul eie beleggers.

Perceptive Advisors, Garabedian se maatskappy, het tot Mei 2026 om 'n $515 miljoen fonds wat in 2021 gesluit is, uit te gee. Verskeie ander risikokapitaal-vennote is naderende soortgelyke terme: Baie het hul laaste fondse in 2020 en 2021 gesluit, toe die COVID-19-pandemie nuwe belangstelling in biotegnologie-belegging aangewakker het.

Copyright © Shanghai Labtech Co.,Ltd. All Rights Reserved